publications

2023

-

Looking back and looking forward: A scientometric analysis of the evolution of corporate sustainability research over 47 yearsSoh Young In, Young Joon Lee, and Robert G. EcclesCorporate Social Responsibility and Environmental Management, 2023

Looking back and looking forward: A scientometric analysis of the evolution of corporate sustainability research over 47 yearsSoh Young In, Young Joon Lee, and Robert G. EcclesCorporate Social Responsibility and Environmental Management, 2023This study systematically reviews the evolutionary trajectory of corporate sustainability research spanning from 1973 to 2019. Through a scientometric analysis of 26,111 Web of Science articles, it demonstrates the continuous development of the conceptual foundations of corporate sustainability, leading to changes in research subjects over time. Despite recent efforts to integrate sustainability into mainstream business models, there remains a lack of consensus on theoretical and methodological frameworks. The study aims to enhance understanding of the conceptual foundations of corporate sustainability by classifying 47 years of research into four major periods: the Dawn of Diverse Ideas (1979–2005), the Rise of Conceptual Frameworks (2006–2011), the Era of Heterogeneity (2012–2015), and the Age of Stakeholder Engagement (2016–2019). The analysis examines the leading research subjects, theories, and perceptions of corporate sustainability in each period, providing a comprehensive review of the evolution of sustainability research. Moreover, the study introduces emerging concepts in the latest sustainability research and underscores the significance of academic research in addressing the current challenges practitioners face.

@article{in2023looking, title = {Looking back and looking forward: A scientometric analysis of the evolution of corporate sustainability research over 47 years}, author = {In, Soh Young and Lee, Young Joon and Eccles, Robert G.}, journal = {Corporate Social Responsibility and Environmental Management}, pages = {1-31}, year = {2023}, doi = {10.1002/csr.2679}, }

2022

- A Study on Responsible Investment Strategies with ESG Rating ChangeYoung Joon Lee, Yun Sik Kang Kang, and Bohyun YoonAsia-Pacific Journal of Busine, 2022

The purpose of this study was to examine the impact of ESG rating changes of companies listed in Korean Stock Exchange on stock returns. Design/methodology/approach - This study collected prices and ESG ratings of all the companies listed on the Korea Composite Stock Price Index. Based on yearly change of ESG ratings we grouped companies as 2 portfolios(upgrade and downgrade) and calculated portfolios’ return. Findings - First, the difference in returns between upgraded and downgraded portfolios is small and statistically insignificant. Second, however, in the COVID-19 period (2020 2021), the upgraded portfolio outperforms the downgraded portfolio by 0.7 percentage points per month. The difference in returns between upgraded and downgraded portfolios is statistically significant after controlling for the Carhart four factors. Lastly, there are much higher volatility when the ESG rating changes are made of companies with low levels of ESG ratings. Research implications or Originality This study is the first to examine the impact of ESG rating changes on stock returns in Korea. Furthermore, the findings can serve as a reference for managers who want to control a firm’s risk by ESG rating changes. Practically, asset managers can use the findings to construct portfolios that are less risky or more profitable than the market portfolio.

@article{lee2022study, author = {Lee, Young Joon and Kang, Yun Sik Kang and Yoon, Bohyun}, title = {A Study on Responsible Investment Strategies with ESG Rating Change}, journal = {Asia-Pacific Journal of Busine}, issn = {2233-5900}, year = {2022}, volume = {13}, number = {4}, pages = {79-89}, }

2020

- Text Mining for Economic AnalysisSoohyon Kim, Young Joon Lee, Jhinyoung Shin, and Ki Young ParkJournal of Korean Econo, 2020

Text mining or natural language processing is a multi-discipline technique that can distill and obtain useful information from text. With the development of AI and increasing abundance of big data, text mining is becoming one of the essential technologies in the fields of business, governement and academia. In this regard, the purpose of this paper is to provide detailed description of how text data analysis can be used for economic analysis by reviewing the key methodologies and related literature. We expect that text mining will complement the limitation of current data and methodologies by serving as a new source of information.

@article{kim2020text, author = {Kim, Soohyon and Lee, Young Joon and Shin, Jhinyoung and Park, Ki Young}, title = {Text Mining for Economic Analysis}, journal = {Journal of Korean Econo}, year = {2020}, volume = {26}, number = {1}, pages = {1-70}, doi = {10.22823/jkea.26.1.202004.1}, }

2019

-

Deciphering Monetary Policy Board Minutes with Text Mining: The Case of South KoreaYoung Joon Lee, Soohyon Kim, and Ki Young ParkKorean Economic Review, 2019

Deciphering Monetary Policy Board Minutes with Text Mining: The Case of South KoreaYoung Joon Lee, Soohyon Kim, and Ki Young ParkKorean Economic Review, 2019We quantify the Monetary Policy Board minutes of the Bank of Korea (BOK) by using text mining. We propose a novel approach that uses a field-specific Korean dictionary and contiguous sequences of words (n-grams) to capture the subtlety of central bank communications. Our text-based indicator helps explain the current and future BOK monetary policy decisions when considering an augmented Taylor rule, suggesting that it contains additional information beyond the currently available macroeconomic variables.In explaining the current and future monetary policy decisions, our indicator remarkably out performs English-based textual classifications, a media-based measure of economic policy uncertainty, and a data-based measure of macroeconomic uncertainty. Our empirical results also emphasize the importance of using a field-specific dictionary and the original Korean text.

@article{lee2019deciphering, title = {Deciphering Monetary Policy Board Minutes with Text Mining: The Case of South Korea}, author = {Lee, Young Joon and Kim, Soohyon and Park, Ki Young}, journal = {Korean Economic Review}, volume = {35}, pages = {471--511}, year = {2019}, publisher = {Korean Economic Association}, } - Measuring Monetary Policy Surprises Using Text Mining: The Case of KoreaYoung Joon Lee, Soohyon Kim, and Ki Young ParkBank of Korea WP, 2019

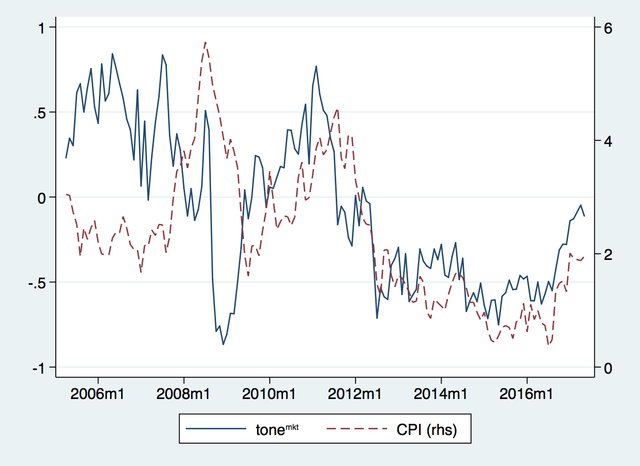

We propose a novel approach to measure monetary policy shocks using sentiment analy-\sis, which is relatively free from specification errors compared to VAR-identified shocks and allows time for a wider circle of market participants to digest information com-pared to shocks identified through intraday Fed futures data. We quantify the tones of news articles around 152 dates of Monetary Policy Board (MPB) meetings of the Bank of Korea (BOK) from 2005 to 2017 and then measure monetary policy surprises us-ing the changes of those tones following monetary policy announcements. We estimate its impact on asset prices and find that it better explains changes in long-term rates, while changes in the Bank of Korea’s base rate and VAR-identified monetary shocks are more closely associated with changes in short-term rates. Our result strongly suggests that a text mining approach to measure monetary policy surprises can be an useful complement to extract market expectations on future monetary policy.

@article{lee2019measuring, title = {Measuring Monetary Policy Surprises Using Text Mining: The Case of Korea}, author = {Lee, Young Joon and Kim, Soohyon and Park, Ki Young}, journal = {Bank of Korea WP}, volume = {11}, year = {2019}, } - Interpreting the Minutes of the Monetary Policy Board through Topic modeling and Sentiment AnalysiYoung Joon Lee, and Bohyun YoonJournal of The Korean Data Analysis Society, 2019

This study investigates the existence of additional information on the monetary policy board (MPB) minutes of the Bank of Korea (BOK) through two types of text mining techniques that have been rapidly developing: topic modeling and sentiment analysis. This study extracts a total of five topics from the whole minutes using the topic modeling analysis and names them as the economy, the monetary policy, the financial market, the prices, and the debt in consideration of the distribution of the words of each topic. The tones of these topics are included in an augmented Taylor rule as additional explanatory variables to analyze the central bank’s interest rate decision. The ordered probit model reveals that tones of the monetary policy, the prices, and the debt have additional information on the current interest rate decision and that the tone of the economy has predictive power for the future interest rate decision. In particular, the fact that there is predictive power in the future has great significance in that it can form the right expectation for the market participants, and an investment strategy using this information will be possible.

@article{lee2019interpreting, author = {Lee, Young Joon and Yoon, Bohyun}, title = {Interpreting the Minutes of the Monetary Policy Board through Topic modeling and Sentiment Analysi}, journal = {Journal of The Korean Data Analysis Society}, issn = {1229-2354}, year = {2019}, volume = {21}, number = {2}, pages = {889-900}, url = {https://doi.org/10.37727/jkdas.2019.21.2.889}, }